TMS Case Studies

A $1.8 billion pharmaceutical company with 10,000 employees in eight states asked Total Management Solutions (“TMS”) to implement a Supplemental Unemployment Benefit (“SUB-Pay”) plan for its planned staff reduction. The SUB-Pay Plan needed to be implemented within 30 days.

With over 25 years of experience implementing SUB-Pay Plans for Fortune 1000 companies, TMS was able to guide the company through the custom design and implementation of their plan within the required 30 days.

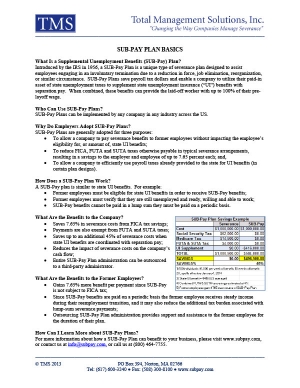

SUB-Pay Plan Basics

Introduced by the IRS in 1956, a SUB-Pay Plan is a unique type of severance plan designed to assist employees engaging in an involuntary termination due to a reduction in force, job elimination, reorganization, or similar circumstance. SUB-Pay Plans save payroll tax dollars and enable a company to utilize their paid-in asset of state unemployment taxes to supplement state unemployment insurance (“UI”) benefits with separation pay. When combined, these benefits can provide the laid-off worker with up to 100% of their pre-layoff wage.